Supported by operators at

Designed for the 95% post alert

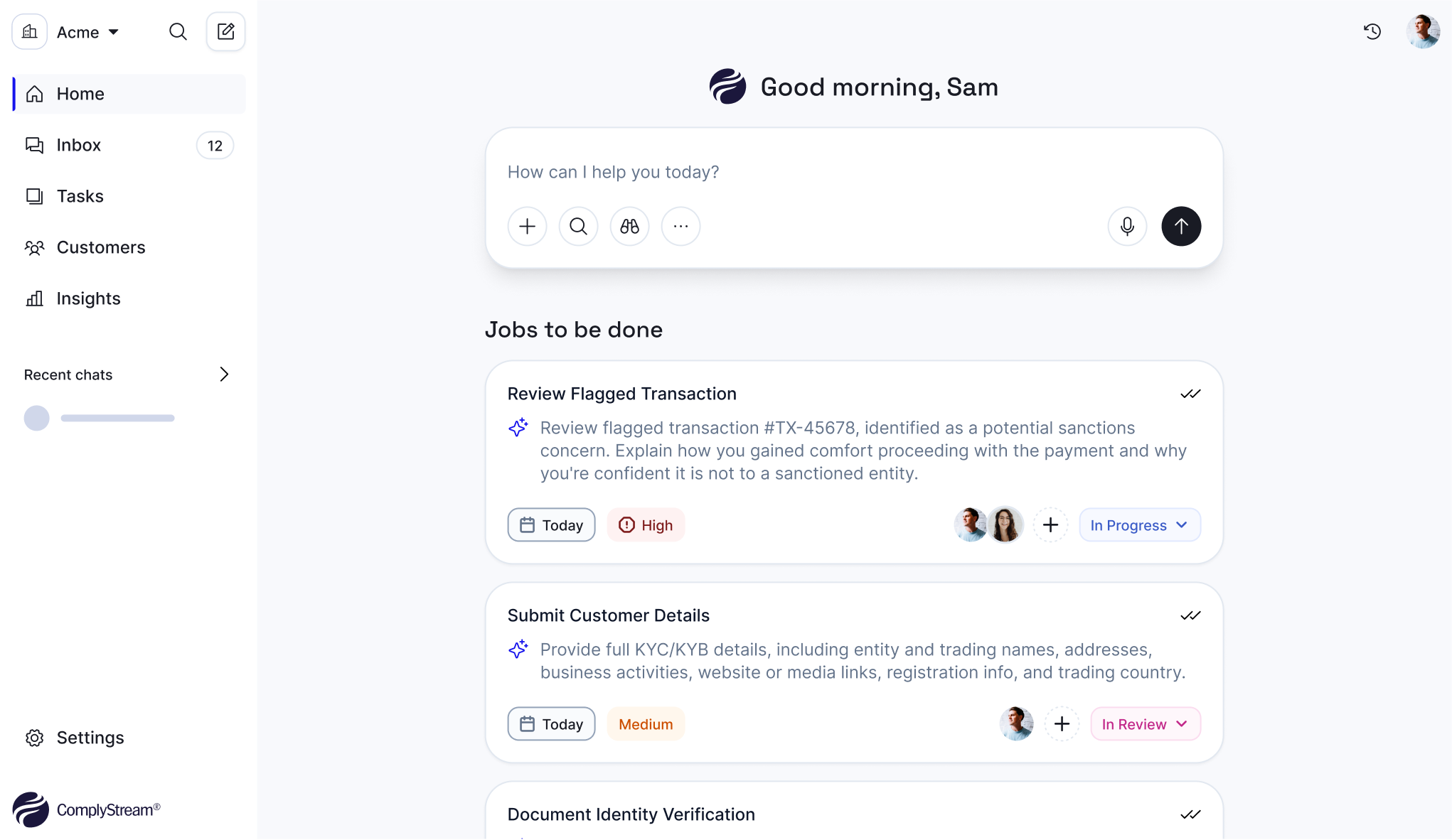

Most tools help you flag alerts. We help you resolve them faster, smarter, and with less manual overhead.

Built for compliance teams who are done with:

Disconnected case tools

Spreadsheet-driven KYC reviews

Email-based RFI chaos

Manual SAR tracking

Sea of open tabs

Key features

What ComplyStream helps with

Customer Risk Assessment

Streamline Customer Onboarding & Risk Management with Dynamic Risk Ratings.

-

Fully customisable risk engine

-

Alerts & audit log for risk changes

-

Proactive KYC refresh

Alert Investigation & Resolution

Streamline Transaction Monitoring Alerts from Ingestion to Resolution with Intelligent Case Management.

-

Vendor agnostic alert ingestion

-

Smart triage & prioritisation

-

Embedded compliance RFI workflows

KYC/KYB refresh

Ad hoc and periodic reviews triggered by expiry, risk changes, or company filings.

-

Risk-based templates

-

Pre-filled task logic

-

In-platfrom

SARs filing

Manage the full SAR lifecycle — from trigger to follow-up — in a single case thread.

-

Case creation from email

-

Centralised audit trail

-

Resolution controls

Book a demo

From manual to modern

Join leading PSPs, fintechs and financial institutions transforming their financial crime operations with ComplyStream. Faster investigations. Fewer escalations. Frictionless compliance. Fill the form to book a non-obligatory demo.

Prefer email? Contact us at info@complystream.com

The future with ComplyStream

A world where payments never stop

“Having witnessed firsthand the profound impact of inadequate compliance on a business, I came to recognize compliance as more than just a safeguard — it can actually be a competitive advantage for Financial Institutions. By enhancing compliance efficiency, we create a win-win situation for everyone involved.”

Kartik, Founder and CEO